Here’s are the latest lease, sales, and construction stats for Chicago industrial real estate market in Q4 2023.

Chicago industrial real estate market expert insight:

While other product types appear to be cooling off and daily discussions remain evident of a looming recession, the industrial market continues to maintain strength across the board.

Vacancy levels remain at historical lows across the US, industrial rents are at premiums and inventory remains scarce in various markets especially for users seeking acquisitions where institutional landlords acquire anything they can get their hands on.”

– Mike Hawryluk, Managing Principal, ICG CRE

Chicago Industrial Real Estate Statistics & Highlights: Leases, Sales, and Under Construction Assets – Q4 2023

We’ve broken the Chicago industrial real estate market summary into 3 main categories: leases, sales, and properties under construction in the area.

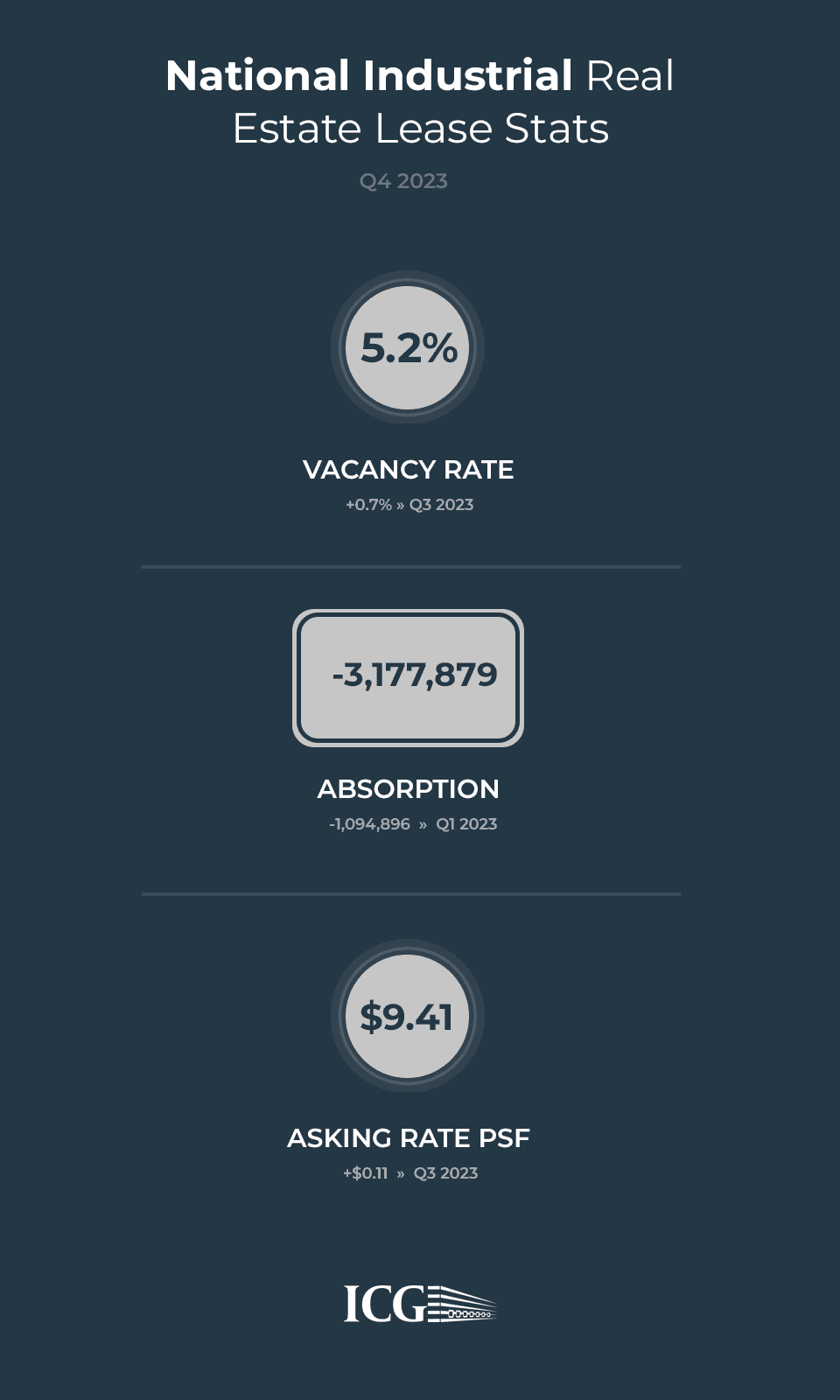

Chicago Industrial Real Estate Lease Stats – Q4 2023

Vacancy: 5.2% (+0.7% from Q3 2023 at 4.5%)

Absorption: -3,177,879 (-1,094,896 compared to Q3 2023 at -2,082,983)

Asking rate PSF: $9.41 (+$0.11 compared to Q3 2023 at $9.30)

Chicago Industrial Leasing Stats – Q4 2023 (Past 12 Months)

12 Month Deliveries in SF: 36M

12 Month Net Absorption in SF: 14.4M

Vacancy Rate: 5.2%

12 Month Rental Growth: 6.3%

Top Chicago Industrial Space Leases Signed (Past 12 Months)

1. 101 W Compass Blvd

Submarket: Joliet Area

Tenant: Target

Size: 1,218,120

2. 2250 Berens Ct

Submarket: Joliet Area

Tenant: Unilever

Size: 1,159,200 SF

3. 5000 183rd St

Submarket: Near South Cook

Tenant: Solo Cup

Size: 1,033,450 SF

4. 555 S Pinnacle Dr

Submarket: South I-55 Corridor

Tenant: Solo Cup

Size: 1,033,450 SF

5. 5400 Rock Run Dr

Submarket: Joliet Area

Tenant: Ecolab

Size: 677,000 SF

Chicago Industrial Real Estate Sales Stats – Q4 2023

During the last 12 months there have been 910 sales comparables in Chicago’s industrial market with an average cap rate of 7.9%. The average price per square foot for these sales was $113, and the average vacancy at the time of the sale was 4.0%.

Sales Comparables: 910

Average Cap Rate: 7.9%

Average Price/ SF: $113

Average Vacancy at Sale: 4.0%

Top Chicago Industrial Sales (Past 12 Months)

Top Transaction Highlight over the last 12 months took place in Q2 2023: CH2 Data Center @ $176,458,584 ($808 / sq ft)

1. CH2 Data Center (2299 Busse Rd)

Price: $176,458,584

Size: 336,000 SF

Price/ SF: $808

Cap Rate: Not Listed

Vacancy: 0%

2. CH1 Data Center (2299 Busse Rd)

Price: $154,270,236

Size: 485,000 SF

Price/ SF: $489

Cap Rate: Not Listed

Vacancy: 0%

3. CH3 Data Center (1400 Devon Ave)

Price: $152,221,180

Size: 305,000 SF

Price/ SF: $768

Cap Rate: Not Listed

Vacancy: 0%

4. Building 1 (21 – 81 N Weber Rd)

Price: $78,178,002

Size: 627,602

Price/ SF: $125

Cap Rate: Not Listed

Vacancy: 0%

5. Building B (310 Overland Dr)

Price: $59,800,000

Size: 543,638 SF

Price/ SF: $110

Cap Rate: Not Listed

Vacancy: 0%

Chicago Industrial Assets Under Construction Stats (Past 12 Months)

There are currently 71 industrial properties under construction in Chicagoland. These assets will add nearly 20M square feet of new product to the market. These properties represents 1.4% of the total industrial real estate inventory in the area, and nearly 35% of the total industrial space under development is pre-leased.

Properties Currently Under Construction: 71

Total Size: 18,723,062 SF

Percent of Inventory: 1.4%

Pre-leased: 34.8%

Chicago Industrial Properties Under Construction

Here are the top-5 largest industrial projects currently under development. The list is led by a new multi-story industrial asset that will add nearly 1.2M square feet of space to the market.

1. 1237 W Division St

Size: 1,184,800 SF

Completion Date: Q3 2024

Developer/ Owner: Not Listed / Logistics Property Company, LLC

Stories: 5

2. Third Coast Intermodal Center (102 W Compass Blvd)

Size: 1,139,153

Completion Date: Q1 2024

Developer/ Owner: NorthPoint Development / Not Listed

Stories: 1

3. 1735 120th Ave

Size: 1,010,880 SF

Completion Date: Q4 2024

Developer/ Owner: Not Listed / Not Listed

Stories: 1

4. Meta DeKalb Data Center (1550 Metaverse Way)

Size: 907,000 SF

Completion Date: Q2 2025

Developer/ Owner: Not Listed / Meta Platforms, Inc

Stories: 1

3. Kraft Heinz (1771 E Gurler Rd)

Size: 775,000 SF

Completion Date: Q2 2024

Developer/ Owner: Trammell Crow Company / The Kraft Heinz Company

Stories: 1

If you’re interested in finding out more about Chicago’s commercial real estate market and keeping up to date on what’s going on, check out our Chicago CRE News page for the latest highlights and transactions.

Sources of Data: ICG CRE & CoStar